It’s good to be a big media network in Latin America.

The big ones are really big relative to their competition, and there are usually only a few. Consequently, they have a lot of negotiating power. “You want to make Colombia’s growing middle class aware of a new, affordable car? You need to advertise on Caracol TV.”

Yet even Latin America is not immune from arguably the biggest technology-driven trend in the media industry, a trend whose impact is only just beginning to be felt by cable companies, networks, content producers/studios, advertisers, and everyone in between: Cord-cutters.

Cord-cutters, in the media definition of the word, refer to people who once had a pay-tv subscription package (usually a cable provider), but have decided to stop this service, effectively ‘cutting the cord’ on their cable package. These new age TV watchers say no thank you to the traditional model, in which a cable company bundles its TV stations together in an all-inclusive package. They are the people behind the rapid growth of Netflix, Amazon Prime, & Hulu.

When I was in Colombia a few weeks ago, I read an article – incidentally in the print edition of a property belonging to one of the aforementioned media groups – about a new product offering from Movistar (part of Telefonica, one of Colombia’s big four cable provider) that will allow for users to view live TV programming across connected devices – which for most Colombians are computers, tablets, and mobile phones – thereby bypassing the traditional ‘bundle’ package.

And they’ll be able to do it largely ad-free.

This is the very interesting bit. Ad-free is a threat to networks’ big revenue stream. Also interesting is that Movistar, which has a business offering traditional TV services to Colombian households, would release a product that competes directly with this ‘traditional’ offering.

Combine this development towards ‘over the top (OTT)’ with Netflix’s recent enormous growth in Latin America, and we are beginning to see in Latin America the incipient stages of the cord-cutting trend and ensuing scramble that is taking place to adapt to consumers’ changing preferences. According to a report from Business Bureau Media Report, more than 10% of 20-30 year olds in Latin America are already cord cutters.

I would be remiss if I didn’t mention a side note about the cord-cutting trend. If you look at the US numbers of people actually cutting the cord, you see that the narrative that people are doing this is more powerful than the results. This isn’t to suggest that there isn’t a real shift taking place in the way that consumers watch TV; today’s non-cable viewers are tomorrow’s cord cutters. But the real number is that cable viewing is down (Thanks Fool); this is different from actually cutting the cord.

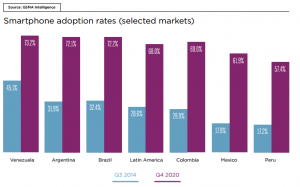

Slowly but surely, however, Movistar’s recent offer in Colombia is evidence that Latin Americans are cutting the cord. These numbers are small, and the power and accessibility of TV (especially for members on the poorer end of the emerging middle class) should not be understated. But in a region where smartphone adoption is poised for triple digit percentage growth over the next five years, more offerings that cater to these habits may be on the way.

Reply